Part I – Regulation

As the largest country in the Association of Southeast Asian Nations (ASEAN), in 2018 Indonesia produces 411 MTOE of primary energy, 261 MTOE is exported mainly as coal and LNG, and 43 MTOE is imported mainly as crude oil and its derivatives. On a side note, Indonesia also consumes 114 MTOE energy (excluding biomass) which accounts for about 40% of the ASEAN energy consumption.

Government of Indonesia has set goals in increasing the share of renewables into national energy mix. As stated in Indonesia’s National Energy Plan (Kebijakan Energi Nasional – KEN), the share of renewable are aimed to increase from 7% today to 23% in the national energy mix by 2025, and 31% by 2050. In this Part I of business environment overview, we will cover the issues on the enabling regulations to help the government in achieving the renewable energy target.

In accordance to the government’s plan to achieve a 35,000 MW electricity capacity and to increase the share of renewable sources in the energy mix, the government has issued several regulations to Independent Power Producers (IPPs) that develop renewable energy sources, namely:

- Tax incentives for renewable energy power generation projects, including hydrogen, CBM, coal gasification, hydro-power, solar, wind, ocean current, and covering:

- Tax allowance as much as 30% from CAPEX, spread evenly within 6 years (PP Nomor 78 Tahun 2019);

- Tax holiday as much as 50% for the first 5 years, followed by 25% for the next 2 years (Perka BKPM Nomor 1 Tahun 2019);

- Lower tariffs for income tax on dividends paid to non-resident taxpayers;

- An extended tax loss carry-forward period of up to 10 years;

- Accelerated depreciation on tangible assets; and

- Accelerated amortization of intangible assets; (c,d,e,f as stipulated by Permen ESDM Nomor 16 Tahun 2015)

- Custom allowance for IPPs for the import of machinery used in energy development projects (Perka BKPM Nomor 6 Tahun 2018);

- A possible exemption on the mandatory use of Rupiah for power plant projects as strategic infrastructure projects (Peraturan BI Nomor 17 Tahun 2015);

In regards to power generation and delivery to PT Perusahaan Listrik Negara (PLN), IPPs are required to obtain an electricity supply business license (Izin Usaha Pembangkit Tenaga Listrik-IUPTL) issued by the government to oversee and review the IPP’s technical and financial capability, and also to fulfill environmental protection requirements. IUPTL applications are submitted to investment coordinating board (Badan Koordinasi Penanaman Modal-BKPM), which is currently applying the One Single Submission (OSS) system. The IUPTL is considered as a business license covering commercial and operational license.

In the most part, PLN is required to purchase electricity based on Power Purchase Agreement (PPA) produced from renewable energy according to these considerations:

- The power generated is in line with supply–demand balance;

- A feasibility and connectivity study has been conducted and verified by PLN;

- Funding is available; and

- The electricity tariff is consistent with ministry regulation

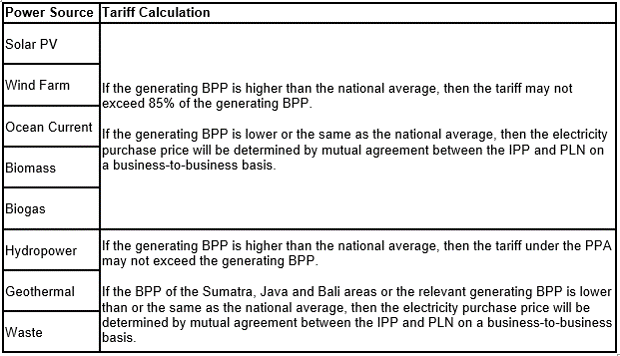

The electricity tariff guidelines for renewable power generation projects are regulated by Permen ESDM Nomor 50 Tahun 2017 and are structured based on PLN’s average electricity generation basic cost from the preceding year. The electricity tariffs for renewable power generation projects are as follows:

The issue on these electricity tariff bench-marking lies on the fact that Indonesia still relies heavily on coal-fired power plants, which are not comparable for the calculation of renewable power generation prices. In turn, this will affect the potential investors to fund the renewable energy projects in Indonesia. Therefore, the government should review and reconsider the methodology to calculate electricity tariff as benchmark for renewable power generation.

Please look forward for Part II, where we will give insights on investment trend in renewable power generation in Indonesia. We hope this regulation overview is helpful, and please write down your thoughts on this topic in the comment section.