As the public often associates these natural resources as the same commodity, oil and gas in Indonesia actually undergo contrasting paths. Known as an exporting country a couple of decades ago, our archipelago has been accepting their status as a net importer for oil since 2003. On the flip side, natural gas still establishes Indonesia as a notable global player for exporting to various countries as well as supplying national demand.

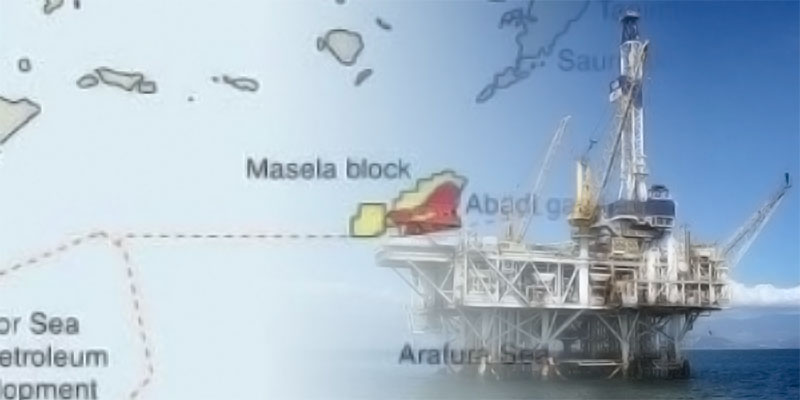

The remarkable national history of natural gas was carved a long ago since Badak NGL and Arun NGL became two of the largest liquefaction plants in the world. Albeit today’s natural gas production is not as immense as those years, their legacy is expected to sustain with several promising projects in the future, which one of them is Masela gas project.With total investment values around US$ 20 billion, this mega project established by the government as one of the national strategic projects. Nevertheless, the project really has a long rocky road from its initial development until today.

INPEX, as the main operator, needs two decades to finally secured the approval for Masela’s plan of development (PoD) just last year. However, instead of having smooth progress on 2020, numerous issues and news circulate that stated Shell as their main counterpart plans to quit with divesting 35% of their shares. While speculations are varied because the official statement has not released from Shell’s side, but the Dutch-based oil company decision is likely stacked up by various reasons from government to economic feasibility. One major government movement that took national attention a few years ago was about the location and capacity of the plant.

Originally, INPEX proposed a 2.5 metric tonne per annum (MTPA) of floating liquefied natural gas (FLNG) as a grand blueprint for this project and previous government era already give them a green-light. But several years later, the current government asked the Japanese company to revise the plan of development (PoD) from offshore to onshore and increased the capacity to 9.5 MTPA.

This conflict didn’t finish in one go since the tension of debate upon the revision was increased across several sides. In addition, there were also numerous related and unrelated stakeholders providing their input regarding the pros and cons of offshore versus onshore which heated up the discussion. Consequently, the additional investment for the onshore increased the cost around US$ 4,5 billion from the initial plan.

Nevertheless, the government inconsistencies don’t seem enough to beat this project up since the operator needs to face another adversity of seeking potential buyers. While it was already hard to find promising off-takers for Masela gas project, Covid-19 pandemic and oil price crash make the nightmare comes faster.

Global gas markets that are actually already in oversupplied state turn into worse condition since the virus succeeds in slowing down the world economy and industry growth that decrease the gas demand significantly. As a company with a hundred years of experiences, Shell surely has a cautious step to invest their cash, and maybe Masela is currently not their choice. At the same time, the recently enacted regulation of 6 US$ gas price for industry and power plant might be indicated another hardship for upstream companies to develop their projects in Indonesia.

The delayed of Abadi LNG project may lead to some compensations for our country. The amount of foreign investment which expected to fill the gap of the state budget to support the economic growth and oil and gas sectors development may not be received on time. Another dreadful news already emerged that stated Chevron also already lost their appetite to develop other upstream megaproject named IDD in Makassar Strait.

The opportunity to have long-term international buyer contracts also might be hard due to the market competition since various LNG plants in Asia Pacific about to be in operation. Last but not least, Indonesia will prolong their dependency to import LPG from Middle East since the city gas pipeline network expansion program to mitigate the increase of import may hamper by the unavailability of gas supply. The current Indonesian Government should learn from past activities when major oil and gas companies such as VICO, Total E&P, BP, and Conocophillips investing on the upstream for decades. Minimizing the issuance of short term regulations and establishing consistent stances are undebatable requirements if the government still want to secure the upstream investments for not going to other promising projects such shale gas development in US. Scrutinize the achievable multiplier effects of the project will narrowing the project scope and make the project cost more efficient.

Now, the circumstances are never been heavier because of the pandemic. The government needs to decide wisely what they will do with our precious natural resources. Every project delay will burden our country with million-dollar of revenue loss. At the end of the day, a simple question will emerge hand on hand with every government decision for this national natural gas megaproject. Quo Vadis, Masela?