The recent cancellation of Sembcorp Industries’ gas deal with Indonesian partners due to regulatory hurdles has raised questions about the future of natural gas supply in the region, particularly concerning the abundant reserves in Natuna and their potential impact on Batam’s market ecosystem. This article explores the implications of this development, assessing whether Batam is prepared for an influx of natural gas and how this situation affects Indonesia’s gas market landscape.

Figure 1. Natuna to Singapore Via WNTS

On March 13, 2025, Sembcorp announced the termination of its gas sales agreement to import natural gas from the Mako gas fields in Indonesia, which was expected to deliver up to BBTUD starting in 2026. The deal’s failure to secure necessary regulatory approvals has not only affected Sembcorp’s immediate plans but also highlighted the complexities of cross-border energy agreements in Southeast Asia. Despite this setback, Sembcorp reassured stakeholders that it would continue to meet Singapore’s energy demands through its existing network of natural gas sources, including liquefied natural gas (LNG) (Reuters).

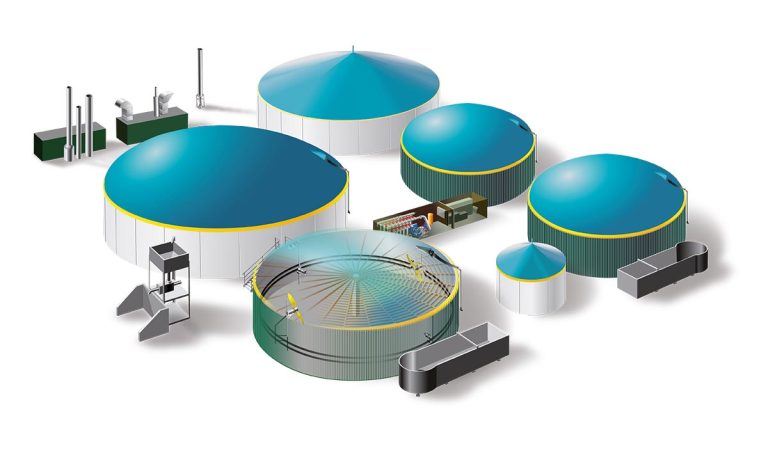

Figure 2. Batam Gas Infrastructure

What are the implications of this situation? Let’s explore three interconnected prerequisites that must be addressed to ensure a balanced and thriving market ecosystem.

- Pipeline Infrastructure Prerequisite

The successful connection of Batam to the abundant natural gas reserves in the Natuna Sea hinges on the development of the WNTS – Pemping Island pipeline section. This infrastructure is crucial for transporting gas from Natuna to Batam. However, recent reports regarding the construction of this pipeline have been unclear and inconsistent. Establishing this section is not just a logistical necessity; it is the backbone that will enable Batam to access and utilize the vast gas resources available in Natuna. Without a reliable pipeline, the potential benefits of these reserves cannot be realized

- Batam’s Natural Gas Market Ecosystem

With the anticipated addition of 100 to 130 MMSCFD from the Mako gas fields, Batam stands at a pivotal moment. This influx of supply aligns with the planned development of data centers and other industries in Batam, which could absorb this additional gas. However, it is essential to adjust the allocation of existing supply sources to maintain a precise supply-demand balance. This balance is critical for fostering a sustainable market ecosystem. If managed effectively, the integration of new supply can stimulate growth and attract further investment in Batam’s energy sector.

- Indonesia’s Gas Market Landscape

The question arises: what if Batam cannot absorb this influx of gas? The cancellation of the Sembcorp deal has opened the door for other suppliers to enter the market, creating a competitive landscape. Buyers in Batam and the surrounding regions must reassess their strategies in light of these new opportunities. Increased competition could lead to more favourable pricing and terms for buyers, but it also necessitates proactive engagement in securing contracts.

Perhaps in the future, there will be changes in terms of gas flow movement? This could involve shifts in supply routes or the emergence of new suppliers, further influencing the dynamics of the market. The interconnectedness of supply, demand, and competition will ultimately shape the future of Indonesia’s gas market.

In summary, the implications of the Sembcorp deal cancellation extend beyond immediate supply concerns. The development of pipeline infrastructure, the readiness of Batam’s market ecosystem, and the dynamics of Indonesia’s gas market landscape are all interlinked. Addressing these prerequisites is essential for Batam to harness the potential of its natural gas reserves and ensure a thriving energy future. Stakeholders must collaborate to navigate these challenges and seize the opportunities that lie ahead.

Please click this link to see more articles

or follow PetroRaya LinkedIn